AI companies are getting huge amounts of money from investors. In 2025, private AI funding has reached record highs. Smart money is flowing into AI startups like never before.

This creates big opportunities for investors who know where to look.

AI Funding Numbers Are Massive

The numbers are incredible. AI companies now get 48% of all venture capital money. That’s up from just 33% in 2024. This is the highest concentration ever seen in startup investing.

Private AI funding hit $252.3 billion in 2024. That’s a 44.5% jump from the year before. The growth shows no signs of slowing down.

The US leads the world in AI investment. American companies raised $109.1 billion in private funding. That’s 12 times more than China and 24 times more than the UK. The gap keeps getting wider.

Big Money, Big Deals

The biggest AI companies are raising enormous amounts. Eight companies got $73 billion in funding rounds over $1 billion each. These aren’t normal startup rounds. These are historic amounts of money.

OpenAI leads the pack with a $40 billion funding round. This values the company at $300 billion. SoftBank and Microsoft led this massive investment. The deal shows how much investors believe in AI’s future.

Scale AI raised $14.3 billion from Meta in a strategic partnership. The deal brought Scale’s CEO to lead Meta’s new AI division. It’s more than just funding – it’s a complete business alliance.

Elon Musk’s xAI raised $10 billion at an $80 billion valuation. The company competes directly with OpenAI and other AI giants. Even controversial figures can raise massive amounts in AI.

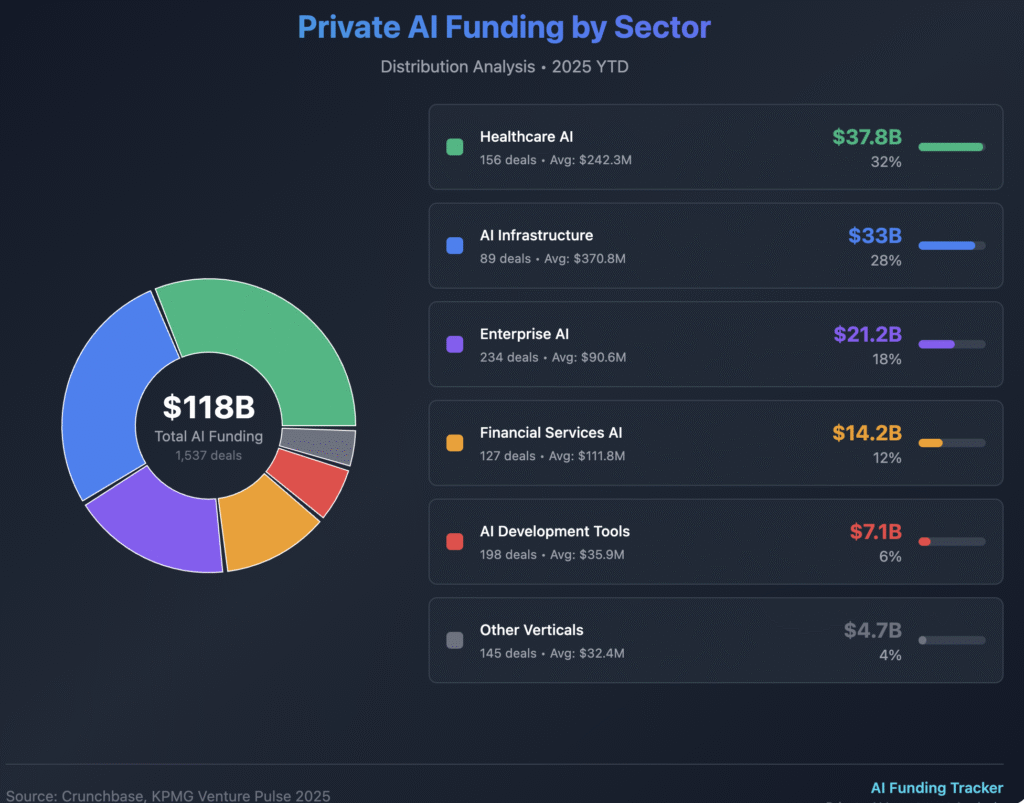

Healthcare AI Is the Hottest Sector

Healthcare AI is the fastest growing investment area. These companies get 62% of all digital health funding. That’s $3.95 billion in just six months of 2025.

The reason is simple: hospitals are desperate for help. Staff shortages are everywhere. AI can do routine work cheaper and faster than humans. Medical imaging gets more accurate with AI assistance. Drug discovery speeds up dramatically with AI tools.

Companies in healthcare AI get paid 83% more than regular health startups. Investors love the business model because healthcare pays well for solutions that work.

AI medical assistants are replacing human workers for basic tasks. Diagnostic tools help doctors spot diseases earlier. Automated billing systems reduce paperwork. New drug discovery platforms find treatments in months instead of years.

The sector keeps growing because the problems are real and the solutions actually work.

AI Infrastructure: Building the Foundation

Building the backbone for AI takes massive investment. Private equity put $108 billion into data centers in 2024. That’s three times more than 2023. The spending will only increase as AI demands more computing power.

Data centers need to handle AI workloads that are much more intensive than regular computing. Energy systems must power these hungry machines. Chip manufacturing has to keep up with demand. Cloud platforms need to support AI development.

Big names like Blackstone and Microsoft are spending billions. The Global AI Infrastructure Investment Partnership plans to invest $100 billion. This money will build the foundation that all AI companies need.

Private equity loves infrastructure investments because they generate steady cash flow. Once built, these systems are hard to replace. Demand keeps growing as more companies adopt AI.

Business AI Applications Get Serious Money

Companies want AI that solves real problems. The money flows to startups building AI for specific industries. Generic AI tools don’t get funded anymore. Investors want to see clear use cases and paying customers.

Banks use AI for trading algorithms and risk management. Law firms deploy AI for contract analysis and legal research. Factories implement AI for quality control and predictive maintenance. Supply chains optimize logistics with AI coordination.

The pattern is clear: AI that saves money or makes money gets funded. Companies that can prove their AI works get premium valuations. Those that just promise future benefits struggle to raise capital.

Harvey raised $300 million for legal AI at a $3 billion valuation. The company serves major law firms with proven results. Sierra reached a $10 billion valuation with $350 million in funding for customer service AI.

Private Equity Changes Its Approach

Private equity firms are getting smarter about AI investing. They’re not just throwing money at any AI startup anymore. The easy money phase is over.

Now PE firms want to see real customers paying real money. They demand clear paths to profitability. Proven business models matter more than flashy technology. Strong management teams with experience get priority.

This shift creates opportunities for solid companies with good fundamentals. Companies that focused on building real businesses instead of chasing hype are now attractive to investors.

PE firms also love AI infrastructure because it’s essential for all AI companies. These investments generate steady returns. The infrastructure is hard to replace once built. Demand keeps growing as AI adoption spreads.

Global Investment Opportunities

America dominates AI funding, but other regions offer interesting opportunities. Competition is less intense outside Silicon Valley. Valuations can be more reasonable. Local problems need local solutions.

Europe raised $69.6 billion in AI funding during 2025. European companies focus on regulation and compliance. They have strong technical talent. Specialized applications get more attention than general AI tools.

The regulatory environment in Europe creates opportunities for AI governance companies. GDPR compliance is mandatory. AI auditing services are needed. Companies that understand both AI and regulations do well.

Asia-Pacific markets have growing digital economies. Government support for AI is strong. Engineering talent is abundant and less expensive. Competition for deals is lower than in the US.

Investment Strategy Evolution

Early AI investing was about big ideas and unlimited potential. Investors funded anything with “AI” in the pitch deck. Those days are over. Now investors demand proof that AI actually works.

What investors look for has changed completely. Measurable results matter more than promises. Compliance with regulations is essential. Recurring revenue models get priority. Clear competitive advantages are required.

This creates opportunities for companies that focused on building real businesses. Startups that can show actual results get premium treatment. Those that built sustainable models during the hype phase are now winning big.

The shift also means less competition for serious investors. Speculative money has left the market. Patient capital that understands AI fundamentals has stayed. This creates better investment conditions for companies with substance.

The M&A Wave Is Building

Big companies are buying AI startups instead of building AI capabilities themselves. This creates clear exit opportunities for investors. The acquisition market is heating up across all industries.

Traditional companies realize they need AI to survive. Building AI teams from scratch takes too long. Buying proven AI companies is faster and more reliable. Competition forces companies to move quickly.

Healthcare companies acquire AI diagnostic tools. Financial firms buy AI trading platforms. Manufacturing companies purchase AI quality control systems. Every industry has AI acquisition targets.

The M&A activity creates a virtuous cycle. Successful exits encourage more AI investing. Entrepreneurs see clear paths to big payouts. More talent enters the AI space. The ecosystem keeps growing.

Future Trends Creating Opportunities

Investment is shifting from basic AI technology to customer-facing applications. Infrastructure is mostly built. Now the focus is on applications that solve specific problems.

Industry-specific AI solutions get premium valuations because they solve clear problems with shorter sales cycles. Competition is less intense in specialized markets. Customers pay more for tools built for their specific needs.

Vertical AI companies understand their industries deeply. They know the pain points and regulatory requirements. They can charge premium prices because they deliver specialized value.

The infrastructure layer keeps evolving too. AI needs better computing power, storage systems, and networking capabilities. This creates ongoing opportunities for infrastructure companies.

Key Investment Areas Right Now

Healthcare AI continues to dominate with medical assistants, diagnostic imaging, drug discovery platforms, and healthcare automation. The sector has proven business models and desperate customers.

Enterprise AI focuses on industry-specific tools, governance and compliance solutions, process automation, and customer service applications. These companies can charge high prices for clear value.

AI infrastructure includes specialized data centers, chip companies, energy solutions, and development platforms. These businesses generate steady returns with growing demand.

The key is finding companies that solve real problems for customers willing to pay. Generic AI tools struggle while specialized solutions thrive. Investors reward companies that understand their markets deeply.

How to Spot Good AI Investments

Look for companies with real customers using their products daily. Growing revenue month-over-month shows market traction. Experienced teams with domain expertise execute better than pure technologists.

Clear competitive advantages protect against copycats. Strong unit economics show sustainable business models. Companies that can explain their value in simple terms usually have real value.

Avoid companies with no paying customers after years of development. Businesses burning cash with no path to profit are risky bets. Generic AI without clear use cases struggles to find customers. Teams without relevant experience often fail to execute.

Easy-to-copy technology gets commoditized quickly. Companies that rely only on hype instead of results eventually crash. Investors are now much better at spotting these warning signs.

The Bottom Line on Private AI Funding

Private AI funding is creating massive investment opportunities for smart investors. The key is finding companies that solve real problems with paying customers and clear growth trajectories.

The AI boom is real and the money flowing into the sector proves it. But the market is getting more selective. Companies need to show actual results instead of just promising future benefits.

Smart investors who focus on business fundamentals while riding the AI wave will do very well. The companies getting funded today are building the tools that will change how we work and live.

This is still just the beginning of the AI revolution. Private AI funding will keep growing, but it will become more focused on companies with proven business models. The winners will combine great AI technology with solid business execution.

The opportunities are enormous for investors who know how to evaluate AI companies properly. The private AI funding boom has years left to run, but only for companies that deliver real value to real customers.

The private AI funding market moves fast with new opportunities emerging every week. Stay informed about the latest deals and trends to spot the best investment opportunities.