Global AI funding reached new heights in Q3 2025, with investors pouring billions into artificial intelligence companies. This quarter showed strong growth and confidence in AI technology across the world.

Quick Summary

- Total global venture funding: $97 billion in Q3 2025

- AI sector funding: $45 billion (46% of all global funding)

- Growth rate: 38% increase compared to Q3 2024

- Top deal: Anthropic raised $13 billion

AI Dominates Investment Landscape

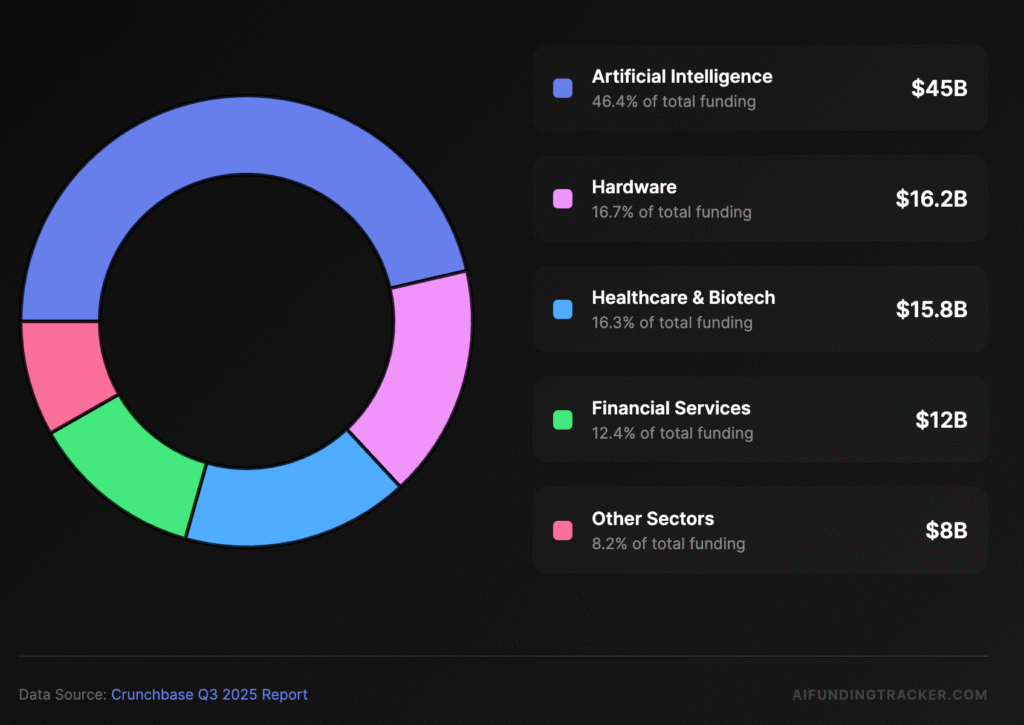

AI companies attracted nearly half of all venture capital in Q3 2025, with the sector receiving $45 billion in funding during the quarter. This represents a massive share of the total $97 billion invested across all industries.

The dominance of AI in venture funding shows how important artificial intelligence has become to investors worldwide. Companies developing AI technology continue to draw unprecedented levels of capital.

Biggest AI Deals in Q3 2025

Three major AI companies raised the largest funding rounds in Q3 2025, all focusing on foundation models:

Anthropic led the pack with a $13 billion Series F funding round at a $183 billion valuation. This was the biggest deal of the quarter. The company, which develops the Claude AI assistant, saw its revenue grow from $1 billion at the start of 2025 to over $5 billion by August 2025.

xAI, Elon Musk’s AI startup, secured $5.3 billion in funding during the quarter. The company raised a combined $10 billion through both debt and equity financing to build out its AI infrastructure and develop its Grok chatbot.

Mistral AI, the French AI champion, raised €2 billion (approximately $2 billion) in a Series C round. This investment doubled the company’s valuation to €12 billion ($14 billion), making it one of Europe’s most valuable tech startups.

These three companies alone pulled in over $20 billion, representing nearly half of all AI funding in the quarter.

Megarounds Shape the Market

Large funding rounds of $500 million or more became the norm in Q3 2025, with these “megarounds” making up over 30% of all venture funding.

Eighteen companies raised megarounds in the quarter. Most of these deals (11 out of 18) happened in September, showing growing momentum as the quarter progressed.

Just 18 companies received one-third of all global venture investment. This shows how capital is flowing to fewer, larger companies rather than spreading across many startups.

Other companies that raised billion-dollar-plus rounds include Princeton Digital Group, Nscale, Cerebras Systems, Figure, Databricks, and PsiQuantum.

What This Means for the Industry

The concentration of funding in AI shows clear trends:

Investor confidence is high. Companies are willing to write large checks for AI technology, especially for foundation models that power the next generation of AI applications.

Foundation models attract the most money. Companies building core AI systems received the biggest investments as they compete to develop more powerful and capable models.

Competition is heating up. Major players are racing to develop better AI technology, with 29% of all AI funding going to a single company, Anthropic.

Other Strong Sectors

While AI dominated, other sectors also performed well in Q3 2025:

Hardware came in second place with $16.2 billion in funding. This included investments in robotics, semiconductors, quantum computing, and data infrastructure companies.

Healthcare and biotech raised $15.8 billion during the quarter, making it the third-largest sector.

Financial services secured $12 billion in funding, ranking as the fourth-largest sector.

Regional Breakdown

The United States led global funding by a wide margin, with American companies raising $60 billion in Q3 2025—nearly two-thirds of all global venture funding.

The US continues to be the main hub for AI investment and innovation. Most major AI deals happened with American companies, though European players like Mistral AI are gaining ground.

Funding by Stage

Late-Stage Funding Surges

Late-stage funding saw the biggest growth in Q3 2025, with companies in later stages of development raising $58 billion—a 66% jump compared to Q3 2024.

The peak quarter for late-stage funding in 2025 was Q1, when OpenAI’s $40 billion round significantly boosted the numbers.

Early-Stage Growth

Early-stage funding also grew, reaching nearly $30 billion across more than 1,700 companies—up just over 10% quarter over quarter and year over year.

Larger Series A and B rounds went to companies working on AI data workloads, energy, quantum, robotics, biotech, and AI applications.

Seed Funding Stays Strong

Seed funding hit $9 billion in Q3 across more than 3,500 companies, up slightly from $8.5 billion invested a year ago.

IPO Market Heats Up

The IPO market showed strong activity in Q3 2025, with 16 venture-backed companies going public with valuations above $1 billion. Together, these IPOs were worth over $90 billion.

The largest venture-backed IPOs in Q3 by value were Chery Automobile, Figma, Klarna, and Netskope.

This was a big improvement from 2024, signaling that the IPO market is recovering and giving startups more exit options.

M&A Activity

In Q3 2025, M&A dollar volume reached $27.5 billion in reported exit value for venture-backed companies, though this was down from $43.6 billion in Q2.

Nine companies were acquired for more than $1 billion each in Q3. Four of these companies were in healthcare and biotech, with the remainder in sectors including cybersecurity, AI, financial services, and product development.

What’s Driving the AI Boom

Several factors are pushing AI funding to record levels:

Real business value. Companies are seeing actual results from using AI in their operations, driving demand for AI solutions.

Competition for AI talent. Investors are paying high prices to secure the best AI researchers and engineers who can build cutting-edge models.

Infrastructure needs. AI requires massive computing power, driving investment in data centers, specialized chips, and cloud infrastructure.

Fear of missing out. Companies worry they will fall behind if they don’t invest in AI now, as the technology rapidly transforms industries.

Looking Ahead

The AI funding boom shows no signs of slowing down. For four quarters in a row, global startup funding has stayed above $90 billion—a level not seen since Q3 2022.

Experts expect AI investment to remain strong through the rest of 2025 and into 2026. As AI technology improves, companies will continue to invest heavily to stay competitive.

The concentration of capital in fewer, larger deals may continue. Investors seem to prefer backing proven companies with strong teams and technology over spreading money across many small startups.

Key Takeaways

Q3 2025 marked a historic quarter for AI funding. The $45 billion invested in AI companies shows massive confidence in the technology and its potential to transform industries.

The rise of megarounds and the concentration of capital in top companies suggests the AI market is maturing. Investors are becoming more selective and focusing on companies with the best technology, teams, and business models.

With global venture funding up 38% year over year, strong growth across all funding stages, a healthy IPO market, and continued innovation, the AI funding landscape looks bright heading into Q4 2025 and beyond.

The competition between major AI players—particularly Anthropic, OpenAI, and xAI—is intensifying as they race to build more powerful models and capture market share. Meanwhile, regional players like Mistral AI are proving that European startups can compete on the global stage.

Want to track AI funding trends? Check our weekly AI funding roundups for comprehensive coverage of the latest investments.