OpenAI started as a nonprofit research lab in 2015. Today, it’s the world’s most valuable startup at $500 billion. The ownership structure has changed dramatically over the years.

This article breaks down exactly who owns OpenAI in 2026, how much each stakeholder holds, and what the October 2025 restructuring means for the company’s future.

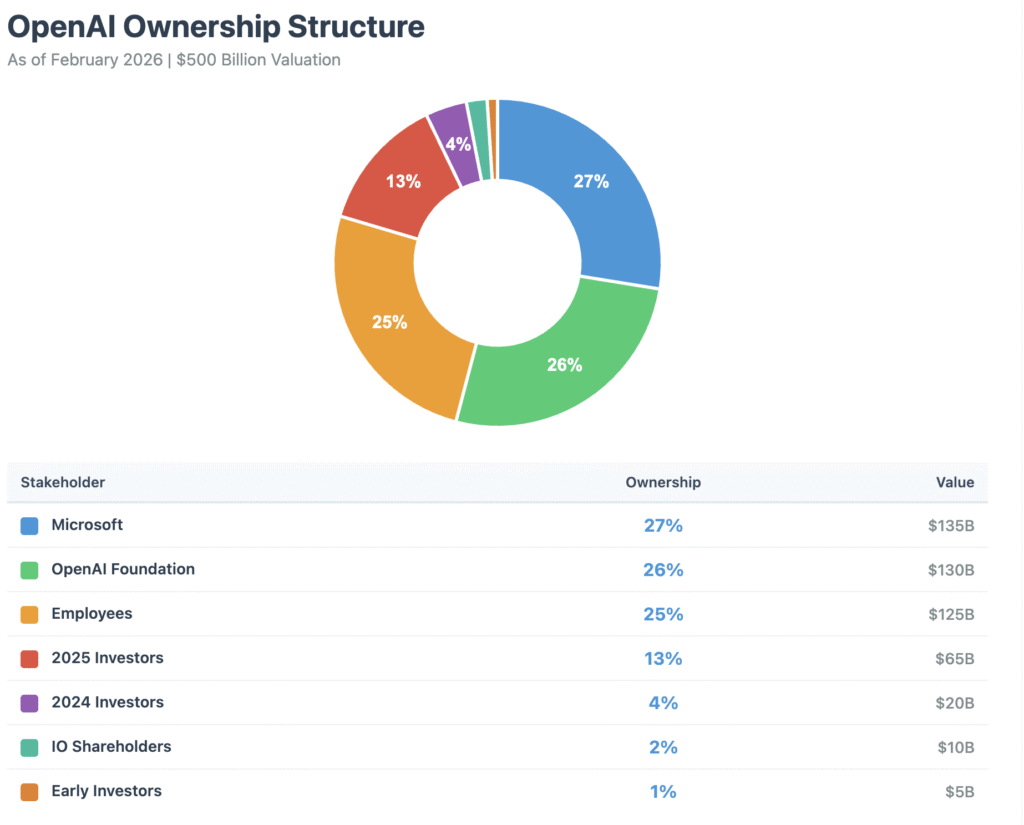

Current OpenAI Ownership Structure (2026)

As of February 2026, following OpenAI’s restructuring in October 2025, here’s the complete ownership breakdown:

- Microsoft: 27% ($135 billion stake)

- OpenAI Foundation (nonprofit): 26% ($130 billion stake)

- Current and former employees: 25% ($125 billion)

- 2025 fundraise investors: 13% ($65 billion)

- 2024 fundraise investors: 4% ($20 billion)

- IO shareholders: 2% ($10 billion)

- Original early investors: 1% ($5 billion)

The total valuation sits at $500 billion based on the October 2025 secondary share sale. Some secondary market investors are trading OpenAI shares at valuations approaching $600-750 billion.

How OpenAI’s Structure Changed in October 2025

OpenAI made a massive shift on October 28, 2025. The company completed a recapitalization that changed everything.

The old structure: OpenAI operated with a nonprofit parent company controlling a “capped-profit” for-profit subsidiary. Investors could earn up to 100x returns, after which all profits reverted to the nonprofit.

The new structure: OpenAI Foundation (the nonprofit) now controls a Public Benefit Corporation (PBC) called OpenAI Group PBC. The Foundation holds 26% equity but retains full control through governance rights.

Why did this happen? OpenAI needed to raise massive amounts of capital. The capped-profit model worked when OpenAI looked like the only major AGI effort. But in 2025, with competitors like Anthropic, xAI, and Google DeepMind, OpenAI needed a simpler capital structure.

The new PBC structure is the same model Anthropic and xAI use. It allows OpenAI to attract traditional investors while maintaining its mission focus. The Foundation’s board appoints all members of the for-profit board, keeping mission-aligned governance intact.

Microsoft’s $135 Billion Stake

Microsoft is OpenAI’s largest external shareholder. The tech giant has invested more than $13 billion in OpenAI since 2019.

Investment timeline:

- 2019: $1 billion initial investment

- 2023: $10 billion additional investment

- 2025: Microsoft’s stake valued at $135 billion (27%)

The October 2025 restructuring changed Microsoft’s relationship with OpenAI. Before, Microsoft was entitled to 49% of profits until hitting certain return thresholds. Now, Microsoft holds conventional equity like any other investor.

But Microsoft negotiated strong protections:

- Commercial rights to OpenAI technologies through 2032

- Early access to research and models

- Extended IP rights for both models and products, including post-AGI models

- OpenAI committed to purchase an incremental $250 billion of Azure cloud services

However, Microsoft gave up some exclusivity. OpenAI can now work with other cloud providers. Microsoft no longer has first right of refusal to be OpenAI’s compute provider. The revenue share agreement remains in place until an independent expert panel verifies OpenAI has achieved AGI.

Microsoft also gained a non-voting observer position on OpenAI’s board after Sam Altman’s brief removal in November 2023. This gives Microsoft insight without direct control.

The OpenAI Foundation’s $130 Billion Stake

The OpenAI Foundation (formerly OpenAI Nonprofit) holds 26% equity worth $130 billion. But here’s what makes this unique: despite owning only 26%, the Foundation controls 100% of OpenAI Group PBC’s decision-making.

How does this work? The Foundation appoints the entire board of the for-profit PBC. All board members serve on both the Foundation board and the PBC board. This governance structure keeps OpenAI’s mission (developing safe AGI that benefits humanity) at the center.

The Foundation announced it will make an initial $25 billion commitment toward health breakthroughs and technical solutions for AI resilience. This shows the nonprofit arm isn’t just symbolic—it has real resources and plans to use them.

Employee Ownership: 25% of OpenAI

Current and former OpenAI employees collectively own 25% of the company, worth approximately $125 billion. This is unusual in tech.

Most companies claw back unvested equity when employees leave. OpenAI includes former employees in the ownership pool. This builds long-term loyalty and keeps alumni financially interested in the company’s success.

In October 2025, OpenAI authorized a $10.3 billion secondary share sale. Current and former employees sold about $6.6 billion of stock to investors including SoftBank, Thrive Capital, and Dragoneer. The lower-than-authorized participation was interpreted as employee confidence in long-term value.

Sam Altman, OpenAI’s CEO and co-founder, has publicly stated he holds zero equity in the company. This is remarkable for a founder leading a $500 billion company. Altman’s compensation comes from his role as CEO, not from ownership.

Major Investors: SoftBank, Thrive Capital, and Others

The 2025 fundraising round brought in new major investors:

SoftBank: The Japanese investment giant completed a $40 billion investment commitment by December 2025. SoftBank invested $7.5 billion directly, syndicated $11 billion with co-investors, and sent a final $22.5 billion in late December. This gives SoftBank approximately 11% ownership in OpenAI.

Thrive Capital: Led by Josh Kushner, Thrive has been a consistent OpenAI investor since 2023. They participated in both the 2024 and 2025 fundraising rounds and the October 2025 secondary sale.

Other major investors from the 2025 round:

- Dragoneer Investment Group

- Coatue

- Altimeter Capital

- MGX (Abu Dhabi sovereign wealth fund)

- T. Rowe Price

Early investors (1% collective stake): The original 2019 investors include Khosla Ventures, Reid Hoffman Foundation, Y Combinator, Paul Buchheit (Gmail founder), and University of Michigan. These early backers invested $194 million in 2019. Their 1% stake is now worth approximately $5 billion.

In December 2025, Disney made a $1 billion equity investment tied to a three-year partnership enabling Disney characters in Sora (OpenAI’s text-to-video model).

OpenAI is reportedly in talks with Amazon for a potential $10+ billion investment, which would further diversify the investor base.

Who Founded OpenAI?

OpenAI was founded in December 2015 by an impressive group of tech leaders:

Original founders:

- Sam Altman (co-chair, now CEO)

- Elon Musk (co-chair)

- Greg Brockman (CTO)

- Ilya Sutskever (Chief Scientist)

- Wojciech Zaremba

- John Schulman

- Andrej Karpathy

- Trevor Blackwell

- Vicki Cheung

- Durk Kingma

- Pamela Vagata

Initial funding pledges:

- Elon Musk

- Peter Thiel

- Reid Hoffman

- Jessica Livingston

- Amazon Web Services

- Infosys

- YC Research

When OpenAI launched, the founding group pledged $1 billion to develop artificial intelligence “for the benefit of humanity broadly.” The original mission focused on ensuring AGI wouldn’t be controlled by a small group of corporations or governments.

The company started as a pure nonprofit research lab. In 2019, facing massive compute costs, OpenAI restructured to include a capped-profit subsidiary. This allowed them to raise the billions needed for advanced AI research.

Elon Musk’s Exit and Ongoing Legal Battle

Elon Musk’s relationship with OpenAI has become one of tech’s most contentious stories.

2015-2017: Musk co-founded OpenAI and was deeply involved in early strategy. He initially pledged $1 billion but according to OpenAI, only contributed $45 million total.

2017: Internal conflicts arose. Musk wanted majority equity, initial board control, and to be CEO of the for-profit entity. OpenAI’s leadership (Altman, Brockman, Sutskever) refused, citing concerns about one person having absolute control.

Musk then proposed merging OpenAI into Tesla, saying Tesla was “the only path that could even hope to hold a candle to Google.” OpenAI declined.

February 2018: Musk left OpenAI’s board. He publicly cited a potential conflict of interest with Tesla’s self-driving car AI development. Internal emails later revealed he told the OpenAI team their “probability of success was 0” and that he would build an AGI competitor.

2023: Musk launched xAI, a direct competitor to OpenAI. xAI raised $18+ billion and builds its own large language models.

2024: Musk filed a lawsuit against OpenAI and Sam Altman, alleging they abandoned the founding mission to develop AI “for the benefit of humanity broadly.” Musk claimed the Microsoft partnership made OpenAI a profit-maximizing entity.

OpenAI countersued in April 2024, calling Musk’s tactics “bad faith” and alleging he wanted to control OpenAI for personal benefit. OpenAI’s legal response included emails showing Musk previously supported creating a for-profit structure.

February 2025: A consortium led by Musk submitted a $97.4 billion unsolicited bid to buy the nonprofit controlling OpenAI. OpenAI rejected the offer on February 14, stating the company was “not for sale.”

The legal battle continues as of February 2026.

What Happens When OpenAI Achieves AGI?

The ownership structure includes specific provisions for Artificial General Intelligence (AGI)—AI systems that match or exceed human intelligence across most tasks.

When OpenAI claims to have achieved AGI, an independent expert panel must verify the claim. Microsoft’s revenue share agreement with OpenAI expires once AGI is verified.

After verification, Microsoft can pursue AGI independently or collaborate with third parties. OpenAI can jointly develop products with other partners outside of Microsoft’s commercial rights.

The original capped-profit structure had a built-in reversion: once all investors hit their return caps, 100% of profits would flow back to the nonprofit. The new PBC structure maintains mission focus but without hard caps on returns.

The Foundation’s control of the board ensures AGI development decisions prioritize safety and broad benefit over pure profit maximization—at least in theory.

OpenAI’s Path to IPO

OpenAI is reportedly preparing for an initial public offering, potentially as early as 2027. Internal targets suggest filing in H2 2026 for a 2027 listing.

The October 2025 recapitalization specifically prepared OpenAI for this path. CEO Sam Altman said the PBC structure and streamlined ownership make an IPO “the most likely path forward” for raising the massive capital needed for AGI development.

At a potential $1 trillion IPO valuation, OpenAI would be one of the most valuable tech companies in history. The listing would give investors like SoftBank an opportunity to realize returns and provide OpenAI with access to public markets for ongoing funding.

OpenAI has committed to spending approximately $1.4 trillion on infrastructure over the next several years. This includes agreements with chipmakers Nvidia, AMD, and Broadcom, and data center projects like the $500 billion Stargate initiative with Oracle and SoftBank.

Key Takeaways on OpenAI Ownership

Here’s what matters about who owns OpenAI in 2026:

1. Microsoft is the largest external shareholder (27%) but doesn’t control the company. The OpenAI Foundation maintains governance control despite holding only 26% equity.

2. The October 2025 restructuring simplified everything. OpenAI moved from a complex capped-profit model to a standard PBC structure that’s easier for investors to understand.

3. Employee ownership (25%) keeps talent engaged. Including former employees in ownership is unusual and creates long-term alignment with the company’s success.

4. SoftBank made a massive bet. The $41 billion investment (11% stake) represents one of the largest AI bets in history. SoftBank liquidated major positions to fund it.

5. The nonprofit still runs the show. Despite being a minority shareholder, the OpenAI Foundation appoints the entire board and maintains mission control.

6. Sam Altman owns zero equity. The CEO who built OpenAI into a $500 billion company holds no ownership stake—a remarkable decision that avoids conflicts of interest.

7. An IPO is coming. OpenAI is laying groundwork for a 2027 public listing that could value the company at $1 trillion.

8. The Musk conflict continues. Legal battles, competing companies (xAI vs OpenAI), and attempted buyouts show deep fractures between the original co-founders.

What This Means for OpenAI’s Future

OpenAI’s ownership structure reflects a unique tension: maximizing commercial success while staying true to a nonprofit mission.

The company needs hundreds of billions of dollars to develop AGI. The new PBC structure and diverse investor base provide that capital. Microsoft’s deep pockets and Azure infrastructure give OpenAI the compute power no other AI company can match at scale.

But maintaining mission focus with $500 billion in shareholder value creates real conflicts. When does profit optimization override safety concerns? The Foundation’s control is designed to prevent this, but history shows that once companies reach certain scale, economic pressures become overwhelming.

Secondary market valuations approaching $750 billion suggest investors believe OpenAI will deliver returns. Whether the company can balance those expectations with safe AGI development remains the defining question of the 2020s AI race.

For now, OpenAI has structured itself to compete commercially while keeping nonprofit governance. Time will tell if this hybrid model works at trillion-dollar scale.