The robotics company behind those walking, talking humanoids closed the biggest funding round in the sector this year. And the numbers are wild.

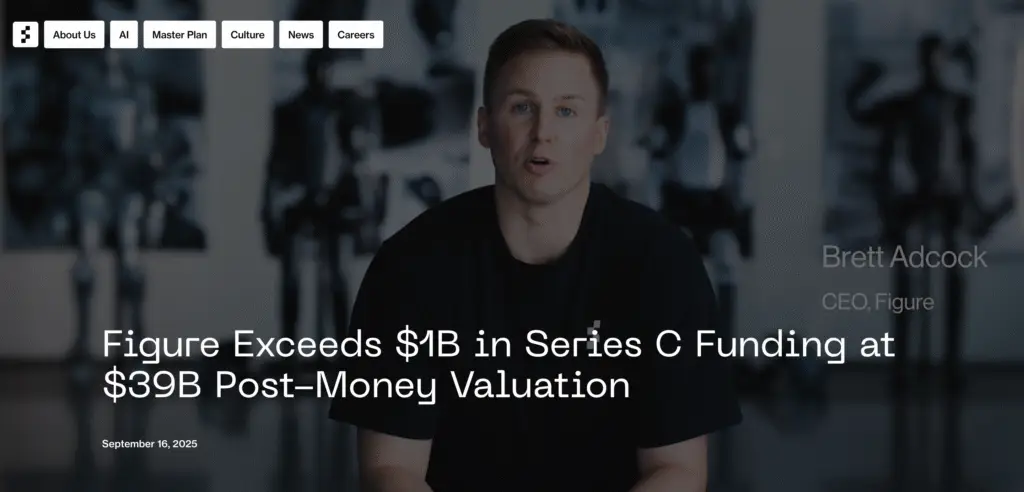

Figure announced Tuesday that it raised over $1 billion in Series C funding at a $39 billion post-money valuation. Yes, that’s billion with a B. The San Jose startup has now raised nearly $2 billion since launching just three years ago in 2022.

Here’s what makes this deal so interesting: Figure is betting big on humanoid robots that work alongside humans in warehouses, factories, and eventually our homes. While most robotics companies focus on specialized machines, Figure is building general-purpose robots that look and move like people.

The round was led by Parkway Venture Capital, with an impressive list of backers jumping in. We’re talking about Nvidia, Intel Capital, Brookfield Asset Management, Salesforce, T-Mobile Ventures, and Qualcomm Ventures. When tech giants like these write checks, they’re not just investing in a company – they’re betting on the future of work itself.

Think of Figure as the company trying to build the robots you see in sci-fi movies. Their humanoid bots are designed to walk, pick things up, and perform tasks that currently require human workers. The idea is that these robots could eventually help in everything from household chores to complex manufacturing jobs.

The timing makes perfect sense when you look at what’s happening in the broader market. Labor shortages are hitting industries hard, especially in warehouses and manufacturing. Companies are desperate for solutions, and humanoid robots could fill that gap.

Figure isn’t alone in this race. The Crunchbase data shows robotics funding is having its best year since 2021, with over $8.5 billion flowing into the sector. Other major players include:

- Apptronik raised $403 million for their Apollo robot

- Field AI secured $405 million for autonomous robot systems

- The Bot Company picked up $150 million for household robots

- Neuralink grabbed $650 million (though they focus on brain-computer interfaces)

Each company is taking a different approach to the same basic problem: how do you build robots that can work in the real world alongside humans?

The company says this massive funding round will go toward three main areas:

First, scaling their robot fleet. Right now, Figure has working prototypes, but they need to build thousands of units to prove their technology works at scale.

Second, building the infrastructure to train robots faster. Teaching humanoid robots to perform complex tasks requires massive amounts of data and computing power.

Third, launching advanced data collection efforts. The more real-world data they gather, the better their robots become at handling unexpected situations.

This funding round signals something important about where investors think technology is heading. We’re moving from software eating the world to robots eating the workforce – but in a good way.

The $39 billion valuation puts Figure in rare company. That’s more than many public companies and signals that investors believe humanoid robots will become a massive market. Some analysts predict the humanoid robotics market could hit $100 billion by 2030.

But here’s the challenge: Figure CEO Brett Adcock claimed earlier this year that Figure was the most “sought-after” stock on private markets. The company has even been sending cease-and-desist letters to secondary market brokers trying to trade their shares without authorization. That suggests huge demand, but also tight control over who can invest.

The robotics space has seen plenty of failures. Companies like Boston Dynamics spent decades building impressive robots that never found real commercial applications. Investors are naturally cautious about betting on hardware companies that require massive upfront capital.

But Figure has something different: a clear path to revenue. Instead of building robots for research or military applications, they’re focused on commercial use cases where companies will pay serious money to solve labor problems.

Let’s be honest about the challenges ahead. Building humanoid robots that can work reliably in real-world environments is incredibly difficult. The technology has to be perfect – one malfunction could hurt someone or damage expensive equipment.

There’s also the question of cost. Even if Figure builds amazing robots, they need to be affordable enough for companies to choose them over human workers. That’s a tough balance between cutting-edge technology and practical economics.

Figure’s massive round is sending ripples through Silicon Valley. Expect more robotics startups to raise bigger rounds in the coming months. Investors are clearly ready to bet big on companies that can solve real labor problems with robotic solutions.

The deal also validates the humanoid approach. Instead of building specialized robots for specific tasks, Figure’s general-purpose humanoids could theoretically learn any job. That flexibility makes them more valuable but also more complex to build.

The next 12 months will be crucial for Figure. They need to show that their robots can work reliably in real commercial environments. Early deployment success could justify that massive valuation and attract even more investment.

Watch for announcements about pilot programs with major companies. If Figure can get their humanoids working successfully in Amazon warehouses or Tesla factories, that could be the proof of concept that launches a robotics revolution.

Figure’s billion-dollar round isn’t just about one company – it’s a signal that the robotics industry is entering a new phase. After decades of research and development, humanoid robots might finally be ready for the real world.

The $39 billion valuation is a big bet on that future. If Figure delivers on their promises, investors could see massive returns. If humanoid robots remain too complex and expensive for widespread adoption, well, that’s a very expensive lesson in the challenges of building the future.

Either way, we’re about to find out whether those sci-fi movies got it right about robots working alongside humans. Figure just raised enough money to give it their best shot.

FAQs

Figure raised $1 billion in Series C funding, achieving a post-money valuation of $39 billion and bringing their total funding to nearly $2 billion since 2022.

arkway Venture Capital led the round, with participation from NVIDIA, Intel Capital, Brookfield Asset Management, Salesforce, T-Mobile Ventures, and Qualcomm Ventures.

Figure plans to use the funding for three main areas: scaling their robot fleet production, building AI training infrastructure, and launching advanced real-world data collection efforts.

Figure focuses on general-purpose humanoid robots that can work alongside humans in various environments, rather than specialized robots for specific tasks like most competitors.

Figure’s $39 billion valuation makes it one of the most valuable private robotics companies, reflecting investor confidence in the humanoid robotics market potential.

Other major robotics funding rounds include Apptronik ($403M), Field AI ($405M), and The Bot Company ($150M), showing strong investor interest in the sector.